Dr Alex Davies unexpected path to practice ownership

She never thought she’d want to own her own practice but then circumstances changed, and Dr Alex Davies had a change of heart.

Learn MoreEconomic and financial market update

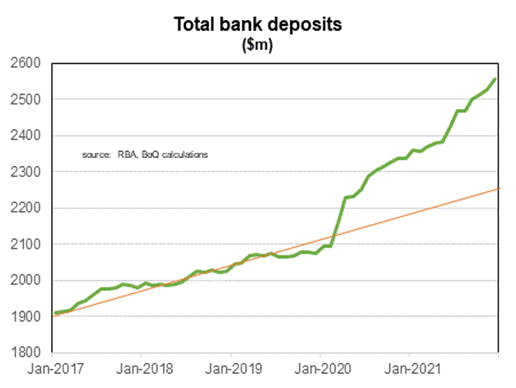

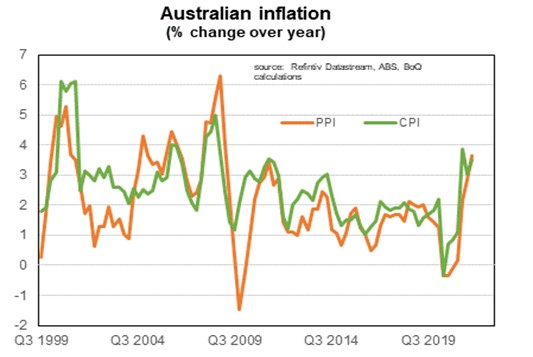

Views on the economic outlook have changed quickly over the course of the pandemic. The RBA thinks that the unemployment rate will be in the 3’s by end-2022 (so apparently does Federal Treasury). The RBA has also dramatically increased their inflation forecasts that are now consistent with rate rises occurring this year (and certainly well before the end of next year). The timing of rate rises will be substantially (but not wholly) determined by wages growth. The RBA believes rising wages growth will be a slow burner, with the fabled 3% figure not hit until towards the end of next year. I think it will be earlier.

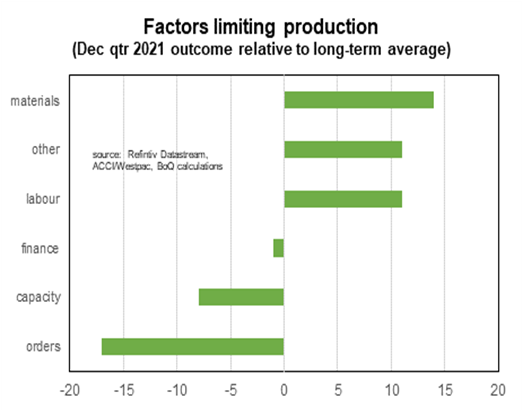

For much of last year the prevailing view was that higher prices was largely a supply problem. These supply problems would prove temporary once the economy fully re-opened. There has been improvement in supply in recent weeks. People working in the global logistics industry think it might take the best part of this year for them to be fully resolved. Worker shortages might be around longer because of lack of immigration and very strong demand workers.

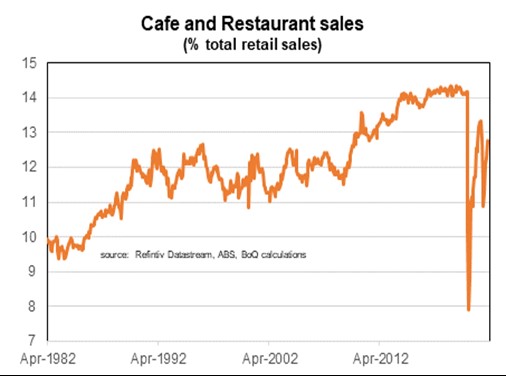

Strong demand has played a role in rising prices. And the fundamentals for further strong spending look good. The problem is we cannot be certain about the future path of the virus. Another COVID wave(s) would complicate matters for the RBA. Spending would slow again, as would the number of hour worked. The virus is having at least as big an impact on the supply side of the economy than demand. And COVID has had a very uneven impact on the economy.

The other issue that may complicate things is developments in the financial sector and movements in overseas interest rates. Currently financial markets are pricing in a higher cash rate not only in Australia but for many of the major global economies. Concerns about rising interest rates are impacting asset markets and has led to some rise in borrowing costs. To date the fall in equity markets and the rise in borrowing costs have been modest. Some further weakness in equity and housing markets would not be enough to stop central banks starting to hike interest rates. But sustained weakness in asset markets might be a bigger worry.

At its February meeting the RBA announced that it would end Quantitative Easing (QE). The RBA believes that its QE program reduced interest rates by 0.2-0.3 percentage points lower than it otherwise would have traded. The ending of QE and the shift to QT (quantitative tightening, when the RBA reduces the size of its balance sheet) will likely have some impact on financial markets and therefore the general economy. This will be happening at the same time as other central banks also undertake QT. Its adds to the upside risk for longer-term interest rates.

In the most likely scenario I expect the first rate increase to be in Q4 (of 0.15%), quickly followed by a second (0.25%) in the same quarter. An earlier move in the third quarter is possible depending upon wage outcomes. I would expect that the cash rate to get to 1% cash rate quite quickly (in the first half of 2023). Thereafter increases in the cash rate are likely to be slower. A number of analysts think the peak in the cash rate will be 1-1.5%. Financial Markets are currently pricing in a peak of 2-2.25%. I think the risks are that the peak could be closer to 3%.

We have a range of offers tailored specifically to your profession. Plus, our strong relationship with industry partners means you can access special discounts and promotions from our preferred suppliers.

The information contained in this webpage is general in nature and has been provided in good faith, without taking into account your personal circumstances. While all reasonable care has been taken to ensure that the information is accurate and opinions fair and reasonable, no warranties in this regard are provided.